are funeral expenses tax deductible in california

The 500000 limitation applies to remuneration that is deductible in the tax year during which the services were performed and remuneration for services during the year that is deductible in a future tax year called deferred deduction remuneration. Enter deductible attorney accountant and tax return preparer fees paid for the estate or the trust.

Event Registration Form Template Word Luxury Conference Registration Form 1 Free Tem Event Registration Registration Form Customer Satisfaction Survey Template

Any Donation you make through the Platform may be processed by an unaffiliated business partner for which a processing fee in addition to our FrontRunner Professional Fee is deducted.

. Travel expenses for members of the family to attend the funeral are not deductible as funeral expenses. Enter the nature of the tax the taxing authority the total tax and the amount of the tax that is not deductible for California purposes on Form 100W Side 4 Schedule A. Burial clubs covered the cost of members funeral expenses and assisted survivors financially.

These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. Line 15a Other deductions not subject to the 2 floor. The 500000 limitation is reduced by any amounts disallowed as excess parachute payments.

You understand acknowledge and agree that. You can use these funds to invest in stocks bonds and mutual funds. After-tax 401k contributions.

You can use this to pay for eligible medical expenses without having to pay taxes. Are Health Insurance Premiums Tax. Campaigns are not charities to which you can make tax-deductible charitable contributions.

Your plan may also permit while you are still employed safe harbor hardship. The 58-year-old worked in the Canyons School District a. See section 162m6 and.

You understand acknowledge and agree that. Burial or funeral expenses Certain expenses to repair casualty losses to a principal residence such as losses from fires earthquakes or floods Certain COVID19-related expenses. Campaigns are not charities to which you can make tax-deductible charitable contributions.

You understand acknowledge and agree that. For tax returns filed in 2022 taxpayers can deduct qualified unreimbursed medical expenses that are more than 75 of their 2021 adjusted gross. For withdrawals because you become totally and permanently disabled for deductible medical expenses over 75 above your income for funds you pay under a qualified domestic relations order or for funds your beneficiary withdraws upon your death.

Explain on a separate schedule all other authorized deductions that are not deductible elsewhere on Form 541. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual. To claim the deduction enter a.

Any Donation you make through the Platform may be processed by an unaffiliated business partner for which a processing fee in addition to our FrontRunner Professional Fee is deducted. 139 allows employers to make tax-free payments to employees to to reimburse or pay them for reasonable and necessary personal family living or funeral expenses they incur due to a national emergency. Enter the total on line 15a.

Any Donation you make through the Platform may be processed by an unaffiliated business partner for which a processing fee in addition to our FrontRunner Professional Fee is deducted. An early form of life insurance dates to Ancient Rome. For 2022 the maximum tax deductible contributions are 3650 for an individual and 7300 for a family.

Campaigns are not charities to which you can make tax-deductible charitable contributions. A Utah teacher was fatally shot Monday when a gun apparently discharged accidentally according to the Summit County Sheriffs Office. A provision of the tax law IRC Sec.

Any Donation you make through the Platform may be processed by an unaffiliated business partner for which a processing fee in addition to our FrontRunner Professional Fee is deducted. Examples of non-tax-deductible medical expenses include funeral or burial expenses nonprescription medicines toothpaste toiletries cosmetics and more. If the corporation is using the California computation method to compute the net income enter the difference of column c and column d on Schedule F line 17.

These investments can help your healthcare fund. Campaigns are not charities to which you can make tax-deductible charitable contributions. The remaining funds can be carried forward to the following year.

California Tax Service Center. Qualified disaster relief payments in this case include amounts paid for an individuals reasonable and necessary personal family medical living or funeral expenses incurred as a result. In 1816 an archeological excavation in Minya Egypt under an Eyalet of the Ottoman Empire produced a NervaAntonine dynasty-era tablet from the ruins of the Temple of Antinous in Antinoöpolis Aegyptus that prescribed the.

The coronavirus pandemic has been declared such an emergency. The Volunteer Income Tax Assistance VITA program offers free tax help to people who generally make 58000 or less persons with disabilities and limited-English-speaking taxpayers who need help preparing their own tax returns. You understand acknowledge and agree that.

The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers particularly those who are 60 years of age and older.

Are Medical Expenses Tax Deductible Community Tax

Can You Claim Funeral Or Burial Expenses As A Tax Deduction For 2019 Cake Blog

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

How To Deduct Medical Expenses On Your Taxes Smartasset

Is It Deductible Taxaudit Blog

Livermore Valley Is Wine S New Hot Spot Hot Spot Wines Valley

Free Rent Increase Letter Template With Sample Pdf Word Eforms Free Fillable Forms Being A Landlord Letter Templates Rental Agreement Templates

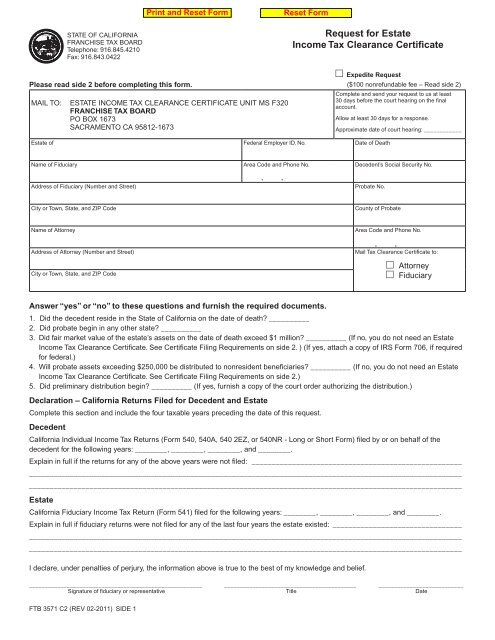

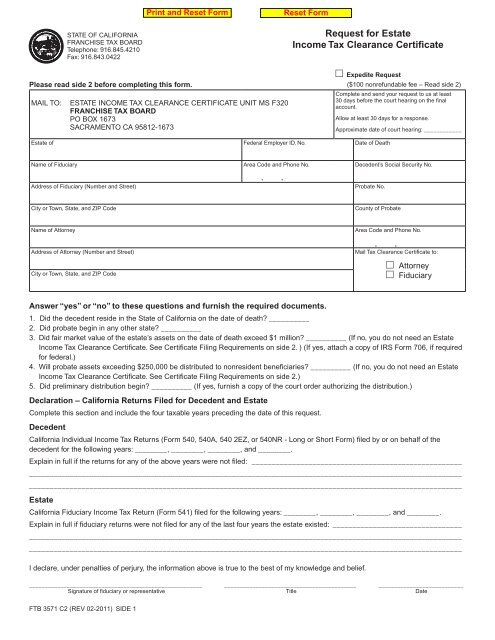

Ftb 3571 Request For Estate Income Tax Clearance Certificate